Robust energy production growth coupled with relatively flat U.S. demand support net energy exports in EIA’s AEO2018

WASHINGTON, D.C. – (RealEstateRama) — The U.S. Energy Information Administration (EIA) released today its Annual Energy Outlook 2018 (AEO2018), which includes its Reference case and a number of sensitivity cases. The AEO2018 Reference case shows continued development of the U.S. shale and tight oil and gas resources paired with modest energy consumption growth, leading to the transition of the United States from a net energy importer to a net energy exporter across most cases examined in AEO2018. “The United States energy system continues to undergo an incredible transformation,” said EIA Administrator Linda Capuano. “This is most obvious when one considers that the AEO shows the United States becoming a net exporter of energy during the projection period in the Reference case and in most of the sensitivity cases as well—a very different set of expectations than we imagined even five or ten years ago.”

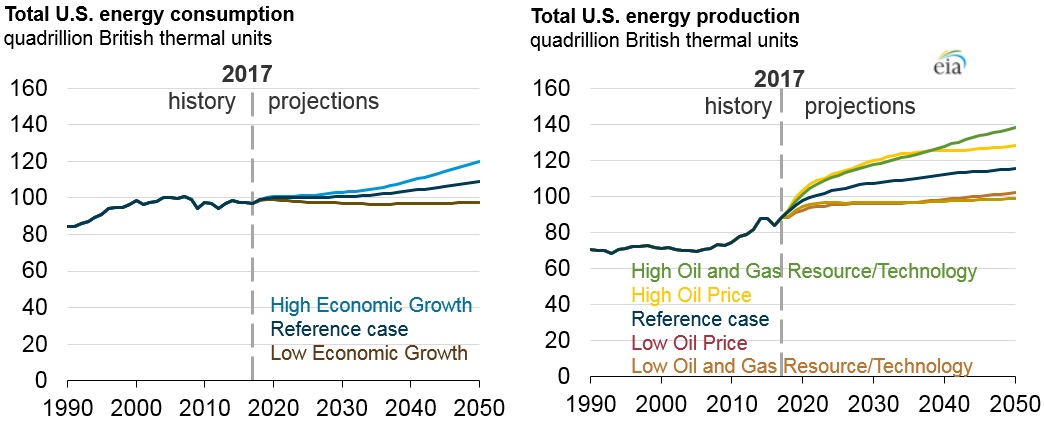

The United States has been a net energy importer since 1953, but AEO2018 projects the United Sates will become a net energy exporter by 2022 in the Reference case. In the AEO2018 sensitivity cases that incorporate assumptions supporting larger growth in oil and natural gas production or that have higher oil prices, this transition is projected to occur earlier. In the High Oil and Gas Resource and Technology case, favorable geology and technological developments produce oil and natural gas at lower prices, supporting exports that increase over time. In the High Oil Price case, before 2040, economic conditions are favorable for oil producers, support higher levels of exports, but lower domestic consumption. After 2040, exports decline as a result of the lack of substantial improvements in technology and production moves to less productive regions.

The AEO2018 presents updated projections for U.S. energy markets through 2050 based on seven cases (Reference, Low and High Economic Growth, Low and High Oil Price, Low and High Oil and Gas Resource and Technology). The AEO2018 Reference case, which incorporates only existing laws and policies, is not intended to be a most probable prediction of the future. The alternative cases incorporate different key assumptions, reflecting market, technology, resource, and policy uncertainties that may affect future energy markets.

Other key findings:

Increases in energy efficiency temper growth in energy demand throughout the projection. Energy consumption grows about 0.4%/year on average in the Reference case from 2017 to 2050. Annual real GDP growth is expected to average 2.0% to 2050 in the Reference case.

Almost all of new electricity generation capacity is fueled by natural gas and renewables after 2022 in the Reference case. This is the result of natural gas prices that remain below $5/million British thermal units until the very end of the projection period and the continued decline in the cost of renewables, especially solar photovoltaic.

Production of U.S. liquids and natural gas continues to grow through 2042 and 2050, respectively. In the Reference case, production of shale gas resources is projected to increase through the end of the projection period. U.S. liquids production begins to decline towards the end of the projection period as less-productive areas are developed.

AEO2018 is a full edition of the AEO, and it incorporates updates on changes in legislation and regulations, and includes a large set of sensitivity and scenario cases with browser tables and spreadsheets for all cases. A series of Issues in Focus articles will be released over the coming months. Sign up for an email notification of the release of the upcoming Issues in Focus articles at: https://www.eia.gov/tools/emailupdates/#forecast.

The projections from the AEO2018 Reference and alternative cases are available at http://www.eia.gov/outlooks/aeo.

EIA Program Contact: Angelina LaRose, 202-586-6135, ">

EIA Press Contact: Jonathan Cogan, 202-586-8719, ">

imagined even five or ten years ago.”