Ginnie Mae exposure to Hurricane(s) Harvey, Irma, and Maria

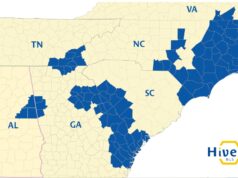

WASHINGTON, D.C. – (RealEstateRama) — Ginnie Mae announced the exposure to its MBS Portfolio by Hurricanes Harvey, Irma, and Maria. The information provided breaks down the number of loans and unpaid principal balance amounts in the presidentially declared disaster areas in Texas, Florida, Georgia, Puerto Rico, and the U.S. Virgin Islands. Additionally, it provides the percentage of Ginnie Mae Single Family GNMA II fixed rate, Multiple Issuer MBS pools impacted. It is important to note, the data below reflects the geographic location of all properties in the affected areas, but does not indicate the percentage of those properties that may have sustained damage during the storm.

Ginnie Mae MBS Aggregate Hurricane Exposure

| ? | ?Loans | ?% of Total | ?UPB (millions) | ?% of Total |

|---|---|---|---|---|

| ??Ginnie Mae Total Outstanding | ?10,959,311 | ? | ?$1,873,685 | ? |

| HARVEY | 275,103 | ?3% | ?$61,357 | ?3% |

| IRMA | 675,456? | ?6% | $111,308? | ?6% |

| MARIA | 115,469? | ?1% | ?11,851? | ?1% |

| ?TOTAL | ?1,066,028 | ?9.7% | ?$184,516 | ?9.8% |

Ginnie Mae Single Family Fixed Rate GNMA II Multiple Issue Pools – % of UPB

| Coupon? | ?Harvey | ?Irma | ?Maria | ?All Hurricanes |

|---|---|---|---|---|

| ?2.50 | ?1.57% | ?5.17% | ?0.12% | ?6.86% |

| ?3.00 | ?1.56% | ?4.82% | ?0.10% | ?6.48% |

| 3.50?? | ?2.08% | ?6.16% | ?0.10% | ?8.34% |

| 4.00?? | ?2.82% | ?7.79% | ?0.10% | ?10.71% |

| 4.50?? | ?3.08% | ?6.88% | ?0.06% | ?10.01% |

| 5.00? | ?3.09% | ?6.08% | ?0.07% | ?9.24% |

| Total?? | ?2.08% | ?5.97% | ?0.10% | ?8.14% |

*Harvey: 39 counties in TX; Irma: 55 counties in FL, PR, GA and US VI; and Maria: 51 counties in PR and US VI

About Ginnie Mae

Ginnie Mae is a wholly owned government corporation that attracts global capital into the housing finance system to support homeownership for veterans and millions of homeowners throughout the country. Ginnie Mae mortgage backed securities MBS programs directly support housing finance programs administered by the Federal Housing Administration, the Department of Veterans Affairs, the HUD Office of Public and Indian Housing, and the Department of Agriculture Rural Housing Service. Ginnie Mae is the only MBS to carry the explicit full faith and credit of the United States Government.

Contact: Michael Huff

(202) 475-4933