WASHINGTON, D.C. – (RealEstateRama) – The American Association of Residential Mortgage Regulators (AARMR) and CSBS will host a summit to bring together policymakers, regulators and the industry to elevate the discussion around mortgage policy on November 13 in Washington, DC.

The summit event will include keynote presentations and panels representing viewpoints on mortgage policy at the national level. Invited speakers include members of Congress, federal agency leadership, industry leaders, consumer advocates, state regulators and other policy stakeholders.

Background

The US housing market is experiencing an all-time high valued at $27.5 trillion, 15% higher than the pre-crisis peak, marked by growing household equity, delayed purchaser entry, historically low interest rates and recovered housing values. However, the market has been constrained by supply and an increasing lack of affordability, impacting low to moderate income and minority home buyers and adding pressure to loosen underwriting standards. The mortgage loan market itself has held steady in the $10 to $11 trillion range for the last 12 years, indicating stability in this crucial sector of the US economy. But, since the end of the financial crisis the industry has seen a dramatic shift in market share of both mortgage originations and servicing from banks to nonbanks, coupled with increased borrower risk profiles and potential credit quality concerns in certain sectors.

Regulators, policy makers and other stakeholders are publicly and privately acknowledging and studying structural shifts in the industry. At the same time, Fannie Mae and Freddie Mac have been in conservatorship as federal policy makers and Congress remain focused on addressing the GSEs as part of larger reforms of the housing finance system.

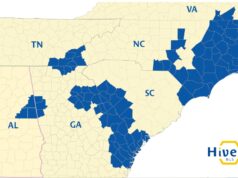

State regulators have an important role and stake in these policy discussions. During the summit, CSBS and AARMR will share how state regulators approach risk management, enhanced prudential standards for nonbank servicers, the use of technology in compliance and supervision and the future of the secondary market.

Press registration: contact Catherine Pickels