Are you a self-employed business owner or a real estate investor struggling to get a traditional mortgage? You aren’t alone. I’ve seen countless capable buyers get rejected by big banks simply because they don’t fit the standard “W-2” mold. That’s where Non-Qualified Mortgages (Non-QM) come in.

In this guide, I’ll break down exactly what these loans are, the specific requirements to qualify, and the honest pros and cons you need to weigh. If you want to skip the research and see if you qualify immediately, you can connect directly with a non-QM loan officer at Bluerate for free, personalized advice.

What is a Non-QM Loan?

A Non-QM (Non-Qualified Mortgage) loan is a type of mortgage that doesn’t meet the strict “Qualified Mortgage” standards set by the Consumer Financial Protection Bureau (CFPB). Unlike conventional loans, they aren’t backed by government agencies like Fannie Mae or Freddie Mac. Instead of relying on standard tax returns to prove income, Non-QM lenders use alternative methods to verify your ability to repay.

From my experience, these loans are designed specifically for people who are financially stable but have complex income streams. They are the go-to solution for self-employed individuals, gig economy workers, and real estate investors who write off significant expenses on their taxes. They are also ideal for foreign nationals or borrowers with high net worth but low monthly taxable income. Essentially, if your bank account looks healthy but your tax return doesn’t tell the full story, a non-QM loan is likely your best path to homeownership.

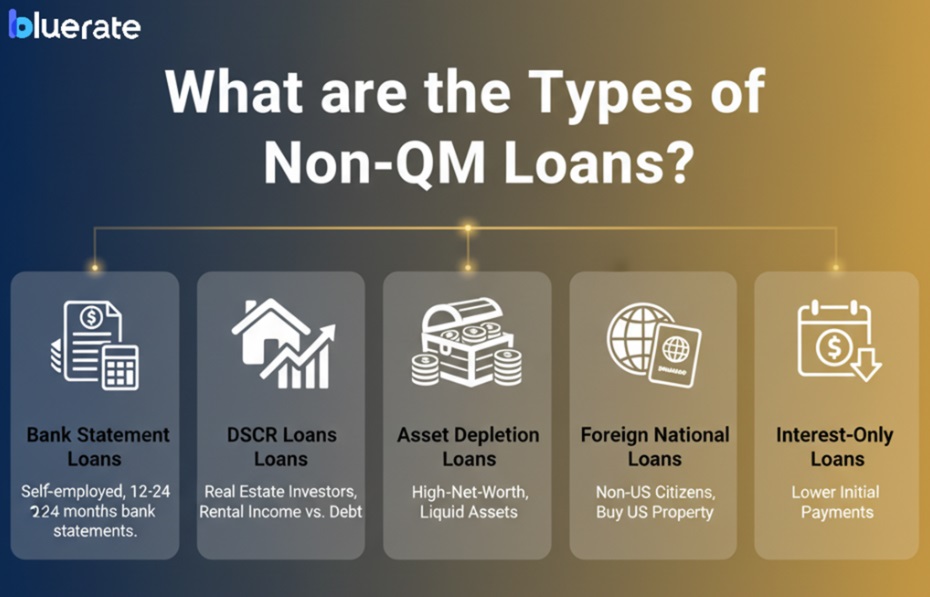

What are the Types of Non-QM Loans?

Because non-QM loans are flexible, there isn’t just one “type.” Lenders have created various programs to fit specific financial situations. Here are the most common ones I encounter:

- Bank Statement Loans: The most popular option for self-employed borrowers. Lenders look at 12 to 24 months of personal or business bank statements to calculate your income, rather than looking at your tax returns.

- DSCR Loans (Debt Service Coverage Ratio): Designed strictly for real estate investors. Approval is based on the property’s potential rental income versus its monthly debt, rather than your personal income.

- Asset Depletion Loans: For high-net-worth individuals who have large savings or investment portfolios but little monthly income. The lender calculates an “income” based on your liquid assets.

- Foreign National Loans: For non-citizens who want to buy US property but lack a US credit history.

- Interest-Only Loans: You only pay interest for a set period, lowering initial monthly payments.

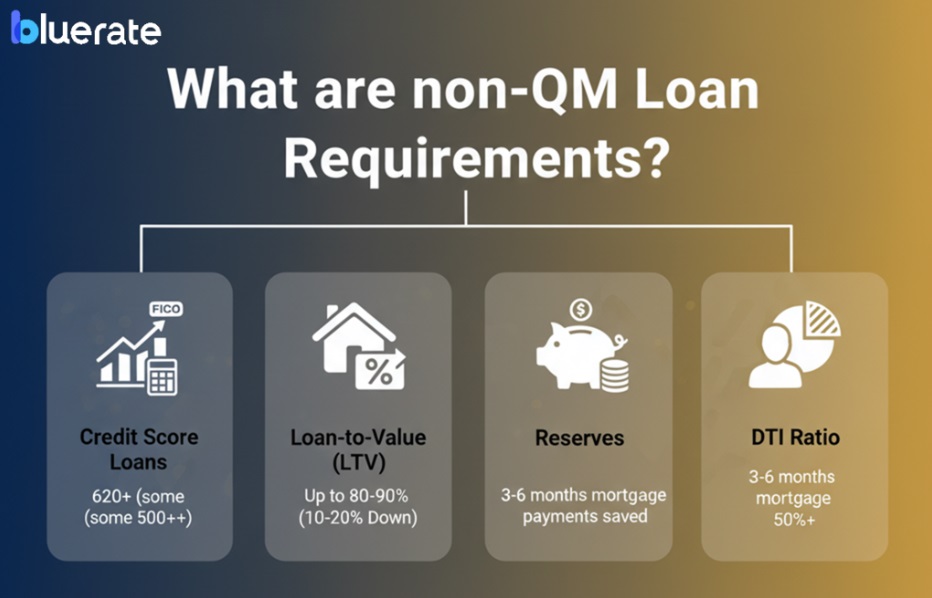

What are non-QM Loan Requirements?

While requirements vary by lender, non-QM loans generally have more flexible criteria than conventional mortgages. However, “flexible” doesn’t mean “no standards.” You still need to prove you can repay the loan.

Here is what you typically need to bring to the table:

- Credit Score: Most lenders look for a FICO score of 620 or higher, though some programs accept scores down to 500 with higher down payments.

- Loan-to-Value (LTV): You can typically borrow up to 80% to 90% of the home’s value, meaning you need a down payment of 10-20%.

- Reserves: Lenders usually want to see that you have 3 to 6 months of mortgage payments saved in liquid cash after closing.

- DTI Ratio: Unlike the strict 43% cap on conventional loans, non-QM lenders often allow a Debt-to-Income ratio up to 50% or even higher, depending on your credit profile.

Pros and Cons of Non-QM Loans

Before diving in, it is crucial to weigh the benefits against the potential downsides. Non-QM loans are powerful tools, but they aren’t for everyone.

The Benefits:

- Flexible Underwriting & Alternative Documentation: You aren’t held hostage by W-2s. Being able to use bank statements or 1099s makes qualification possible for entrepreneurs.

- Wider Eligibility: They are a lifeline for borrowers with “credit events” like a recent foreclosure or bankruptcy who can’t wait the standard 2-7 years to buy again.

- Loan Feature Flexibility: Options like interest-only payments can significantly help with cash flow management, especially for investors.

- Property Investor Options: DSCR loans allow investors to scale their portfolios based on the property’s performance, not their personal DTI.

The Drawbacks:

- Expect Slightly Higher Rates: Because lenders take on more risk without government backing, interest rates are typically 0.5% to 1% higher than conventional loans.

- Larger Down Payments: You rarely find 3% down options here. Expect to put down at least 10% to 20%.

- Increased Borrower Risk: Features like balloon payments or interest-only periods require financial discipline to manage safely.

- Fewer Consumer Protections: Since they fall outside some CFPB regulations, it is vital to read the fine print carefully.

- Limited Availability: Not every bank offers them; you need a specialized lender.

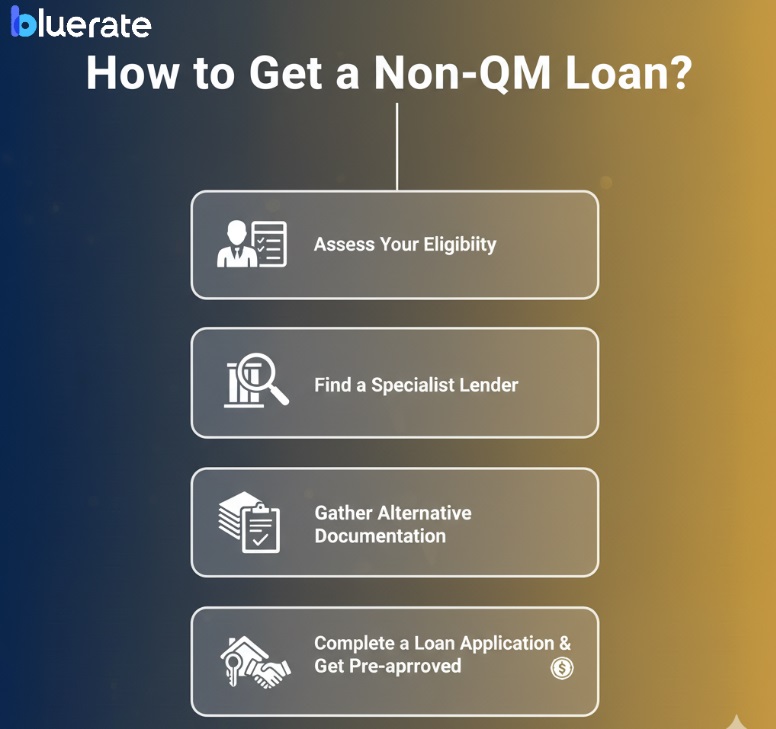

How to Get a Non-QM Loan?

Getting a non-QM loan is less about checking boxes and more about telling your financial story. Here is the step-by-step process to secure one.

Assess Your Eligibility

First, take an honest look at your finances. Are you self-employed with strong cash flow but low taxable income? Do you have a “bruised” credit history from a past event? Calculate your liquid assets and estimate your credit score.

I always advise clients to pull their own bank statements for the last 12 months beforehand. If your deposits show consistent income, you are likely a good candidate. Understanding your own financial picture helps you choose the right program—whether that’s a Bank Statement loan or an Asset Depletion loan—before you even talk to a lender.

Find a Specialist Lender

This is the most critical step. Most big-box banks simply don’t offer these products. You need a specialized lender who understands complex income structures. I highly recommend using Bluerate for this. Unlike generic lead sites that sell your info, Bluerate helps you find and verify specific Loan Officers near you with a direct connection.

Why I recommend Bluerate:

- True, Personalized Rates: You get real-time rates based on your actual data (credit score, purchase price, income), not misleading “teaser rates” that change later.

- Seamless Digital Process: You can pre-qualify online, easily complete the standard 1003 loan application, and even export your data in FNM 3.4 format, which is the industry standard for smooth processing.

- Transparency: Their system integrates with Loan Origination Systems (LOS), allowing you to track your loan’s progress in real-time.

- Security: Bluerate is SOC 2 Type II certified, meaning your personal data is secure. You won’t get bombarded by spam calls from random lenders.

Gather Alternative Documentation

Once you have connected with a loan officer on Bluerate, you’ll need to prove your income. Forget the standard tax returns. If you are applying for a Bank Statement Loan, be prepared to submit 12 to 24 months of personal or business bank statements.

If you are an investor using a DSCR loan, you will need a schedule of real estate owned and a lease agreement (or rent schedule) for the property you are buying. Having these documents organized in a digital format upfront will speed up the process significantly and show the lender you are a serious borrower.

Complete a Loan Application & Get Pre-approved

After submitting your documents, you will move to the formal application. This involves a hard credit pull and a detailed review of your application. The goal here is to get a formal Pre-Approval Letter. In the non-QM world, a pre-approval is vital because it tells sellers that a lender has already vetted your unique income situation. Unlike a simple pre-qualification, this letter carries weight. With Bluerate’s platform, you can often complete the 1003 form online, streamlining what used to be a messy paperwork process.

Underwriting and Closing

Finally, your file goes to underwriting. Non-QM underwriting is “manual,” meaning a human (not just a computer) reviews your file to make sense of your financial story. They might ask for letters of explanation regarding large deposits or credit dips. This is normal.

Once the underwriter clears the file, you’ll get a “Clear to Close.” You will sign the final documents, pay your down payment and closing costs, and get the keys. While it sounds complex, a good loan officer will guide you through every request.

Conclusion

Non-QM loans are more than just a financing option; they are a vital bridge for borrowers who don’t fit the traditional banking mold. Whether you are a business owner, an investor, or recovering from a credit event, these loans offer a legitimate path to homeownership. The key is working with a transparent platform that protects your data and gives you honest rates. If you are ready to see what you qualify for without the hassle of cold calls, I recommend you head over to Bluerate to find a verified non-QM loan officer today.