MBA updates methodology and releases revised historical data

WASHINGTON, D.C. (August 8, 2016) – (RealEstateRama) — Mortgage credit availability increased in July according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) which analyzes data from Ellie Mae’s AllRegs® Market Clarity® business information tool. Starting this month, MBA has updated its methodology to better measure credit availability and has released a new historical series based on this updated methodology. As part of this change the Conforming and Jumbo MCAIs have been updated to only include conventional, non-government loan programs. More information about these changes is available at www.mba.org/MortgageCredit.

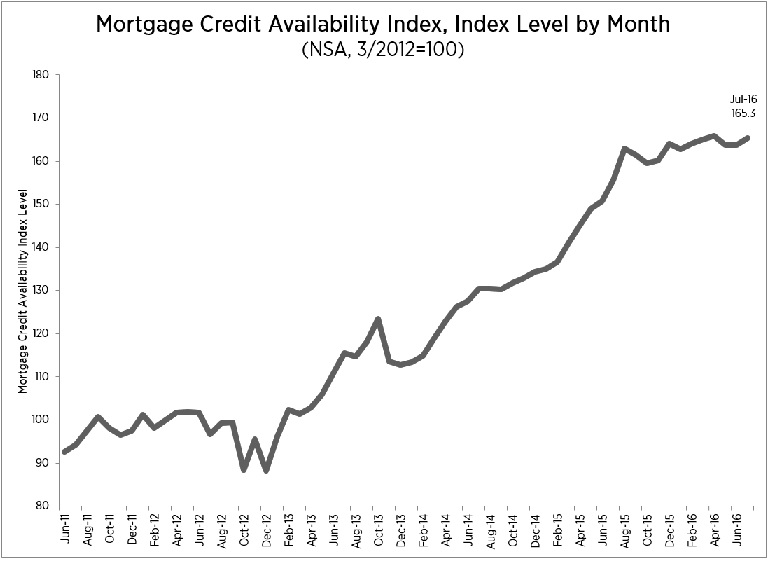

The MCAI increased 1.0 percent to 165.3 in July. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012. Of the four component indices, the Jumbo and Government MCAIs saw the greatest increase in availability (both up 1.3 percent) over the month followed by the Conventional MCAI (up 0.7 percent), and the Conforming MCAI (up 0.1 percent).

“In the three years since its inception, we have been monitoring the MCAI, always looking for opportunities to improve the series and provide a more accurate gauge of credit availability. We expanded our historical series to cover over 10 years of historical data, and followed that with the introduction of four MCAI sub-indices (Conventional, Government, Conforming, and Jumbo) to help users better understand what is driving changes in the overall MCAI. Today we are excited to announce an updated methodology that responds more effectively to changes in the marketplace and better accounts for the frequent addition and subtraction of investor offerings,” said Lynn Fisher, MBA’s Vice President of Research and Economics. “While using the exact same data, this updated methodology does a better job of reflecting new loan programs that did not exist in the base month of the index (March 2012). In addition we are redefining our conforming and jumbo indices to be restricted to conventional loan programs only. Previously, conforming and jumbo status was determined solely by loan size. In the new methodology, high balance FHA and VA loan programs are not included in the jumbo category.”

“The main difference with this change is that the prior methodology had shown a tightening of credit over the past few months. The new methodology shows a modest loosening of credit availability over this time period, in line with other indicators of credit availability. This is a result of new jumbo loan offerings that did not exist in our 2012 base period becoming more popular and prevalent in recent periods. Our new methodology captures the addition of these new loan offerings more effectively and better aligns with anecdotal evidence of loosening credit conditions over the last seven months.”

Fisher continued, “The overall credit availability increase in July was driven by an uptick in programs that allow for refinancing among relatively lower credit score borrowers. We observed this trend in both the conventional and government programs.”

CONVENTIONAL, GOVERNMENT, CONFORMING, AND JUMBO MCAI COMPONENT INDICES

Of the four component indices, the Jumbo and Government MCAI saw the greatest loosening (both up 1.3 percent) over the month followed by the Conventional MCAI (up 0.7 percent), and the Conforming MCAI (up 0.1 percent).

The Conventional, Government, Conforming, and Jumbo MCAIs are constructed using the same methodology as the Total MCAI and are designed to show relative credit risk/availability for their respective index. The primary difference between the total MCAI and the Component Indices are the population of loan programs which they examine. The Government MCAI examines FHA/VA/USDA loan programs, while the Conventional MCAI examines non-government loan programs. The Jumbo and Conforming MCAIs are a subset of the Conventional MCAI and do not include FHA, VA, or USDA loan offerings. The Jumbo MCAI examines conventional programs outside conforming loan limits while the Conforming MCAI examines conventional loan programs that fall under conforming loan limits.

The Conforming and Jumbo indices have the same “base levels” as the Total MCAI (March 2012=100), while the Conventional and Government indices have adjusted “base levels” in March 2012. MBA calibrated the Conventional and Government indices to better represent where each index might fall in March 2012 (the “base period”) relative to the Total=100 benchmark.

EXPANDED HISTORICAL SERIES

The Total MCAI has an expanded historical series which gives perspective on credit availability going back approximately 10-years (expanded historical series does not include Conventional, Government, Conforming, or Jumbo MCAI). The expanded historical series covers 2004 through 2010, and was created to provide historical context to the current series by showing how credit availability has changed over the last 10 years – this includes the housing crisis and ensuing recession. Data prior to March 31, 2011, was generated using less frequent and less complete data measured at 6-month intervals and interpolated in the months between for charting purposes. Methodology on the expanded historical series from 2004 to 2010 has not been updated.

Data prior to 3/31/2011 was generated using less frequent and less complete data measured at 6-month intervals interpolated in the months between for charting purposes.

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for over 95 lenders/investors are combined by MBA using data made available via the AllRegs® Market Clarity® product and a proprietary formula derived by MBA to calculate the MCAI, a summary measure which indicates the availability of mortgage credit at a point in time. Base period and values for total index is March 31, 2012=100; Conventional March 31, 2012=69; Government March 31, 2012=222.

To learn more about the AllRegs Market Clarity platform click here.

For more information on the Mortgage Credit Availability Index, including Methodology, Frequently Asked Questions and other helpful resources, please click here or contact .

CONTACT

Ali Ahmad

(202) 557- 2727