Archives

Dividing Assets Made Easy: How to Sell Your House Quickly to a Cash Buyer

When facing the complexities of dividing assets, the urgency to sell your house quickly can become paramount. Whether you’re navigating a divorce, settling an estate, or simply wishing to

Busting the Top Myths About Cash Home Buyers in 2025!

In today's fast-paced real estate market, cash home buyers have become a prominent force, often surrounded by a cloud of myths and misconceptions. As we delve into 2025, understanding who

Pending Home Sales Waned 4.6% in January

Pending home sales pulled back 4.6% in January according to the National Association of REALTORS®. The Midwest, South and West experienced month-over-month losses in transactions – with the most significant drop in the South – while the Northeast saw a

January New Home Purchase Mortgage Applications Decreased 6 Percent

The Mortgage Bankers Association (MBA) Builder Application Survey (BAS) data for January 2025 shows mortgage applications for new home purchases decreased 6 percent compared from a

Families Must Spend 38% of Their Income on Mortgage Payments

In a clear sign illustrating the housing affordability challenges facing Americans, the National Association of Home Builders (NAHB)/Wells Fargo Cost of Housing Index (CHI) found that in the

Share of Mortgage Loans in Forbearance Decreases to 0.40% in January

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 7 basis points from 0.47% of servicers’

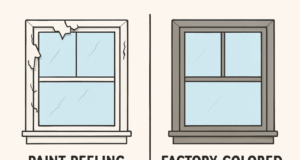

Understanding Homeownership Costs and Responsibilities

Homeownership is a significant milestone, often symbolizing financial stability and personal success. However, owning a home comes with more than just the joy of having a place to call your

San Francisco Association of REALTORS® Brings AI-Powered MLS Listing Automation by Restb.ai to Both...

The San Francisco Association of REALTORS® (SFAR) will bring AI-powered MLS Listing automation to its 4,000+ members with

Nearly 90% of Metro Areas Registered Home Price Gains in Fourth Quarter of 2024

Almost 90% of metro markets (201 out of 226, or 89%) experienced home price increases in the fourth quarter of 2024, as the 30-year fixed mortgage rate ranged from 6.12% to 6.85%,

Mortgage Delinquencies Increase in the Fourth Quarter of 2024

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.98 percent of all loans outstanding at the end of the fourth

HUD Updates Options to Help Homeowners Keep Their Homes

Revised Federal Housing Administration loss mitigation waterfall includes updates to tools for mortgage servicers helping borrowers who fall behind on their mortgage payments.

Cash Buyers vs. Mortgage Buyers: What Sellers Should Consider

Selling a home can feel overwhelming, especially when deciding between cash buyers and mortgage buyers. Each option has unique pros and cons, and your choice will depend on your

How Rising Interest Rates Impact Mortgage Loan Processing

The mortgage industry faces new operational challenges because interest rates keep increasing. As part of this industry transition, lenders now need to follow different procedures for home loan processing. Higher interest rates introduce complications that affect lenders' and borrowers' operations.

Share of Mortgage Loans in Forbearance Decreases Slightly to 0.47% in December

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 3 basis points from 0.50% of servicers’

December New Home Purchase Mortgage Applications Increased 8.9 Percent

The Mortgage Bankers Association (MBA) Builder Application Survey (BAS) data for December 2024 shows mortgage applications for new home purchases increased 8.9 percent

MBA Statement on FHFA and Treasury Amendments to the Preferred Stock Purchase Agreements

MBA’s President and CEO Bob Broeksmit, CMB, issued the following statement on today’s Federal Housing Finance Agency

Mortgage Credit Availability Decreased in November

Mortgage credit availability decreased in November according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) that analyzes data from ICE

HUD Announces 2025 Loan Limits

New Federal Housing Administration loan limits for Single Family Title II forward and Home Equity Conversion Mortgages go up for calendar year 2025. The U.S. Department of Housing and Urban Development’s (HUD) Federal Housing Administration (FHA)

Mayor Bowser, DCHA & POAH Celebrate Ribbon Cutting and Groundbreaking of Affordable Housing Developments...

Mayor Muriel Bowser and the Office of the Deputy Mayor for Planning and Economic Development (DMPED), with the District of Columbia Housing Authority (DCHA) and nonprofit developer Preservation of Affordable Housing (POAH) today celebrated the grand opening of The Asberry, a mixed-use building with 108 units of affordable rental housing with a preference for those aged 55+.

Mortgage Application Payments Increased 4.2 Percent to $2,127 in October

Homebuyer affordability declined in October, with the national median payment applied for by purchase applicants increasing to $2,127 from $2,041 in September. This is according to the