Archives

THE MILLIONAIRE’S BLUEPRINT: HOW THE TOP 5% CREATE WEALTH WHILE EVERYONE ELSE WORKS FOR...

The strategic process of buying 2nd property in Singapore represents the critical inflection point where ordinary income-earners separate themselves from true wealth builders who understand the power of leverage and asset acquisition. I'm going to be BRUTALLY HONEST with you—while most people are obsessing over saving a few percentage points on their mortgage interest rate

MISMO Publishes Enhanced Reference Models

MISMO®, the real estate finance industry's standards organization, today announced that enhancements to the MISMO Version 3.6 Reference Model and the new MISMO Version 3.6.1 Reference Model has reached “Candidate Recommendation”

ALTA Renews TIAC as 2025 Elite Provider

American Land Title Association (ALTA), the national trade association of the land title insurance industry, announced it has renewed TIAC as an ALTA Elite Provider for 2025. ALTA’s Elite Provider Program features distinguished service providers

Single-Family Starts Down on Economic and Tariff Uncertainty

Economic uncertainty stemming from tariff issues, elevated mortgage rates and rising building material costs pushed single-family housing starts lower in April.

IMBs Report Slight Production Losses in First Quarter of 2025

Independent mortgage banks (IMBs) and mortgage subsidiaries of chartered banks reported a pre-tax net loss of $28 on each loan they originated in the first quarter of 2025, compared to a

Mortgage Credit Availability Remained Unchanged in April

Mortgage credit availability remained unchanged in April according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) that

MBA Statement on Senate Bill Introduction to Raise FHA Multifamily Loan Limits

MBA President and CEO Bob Broeksmit, CMB, released the following statement regarding the introduction from Senators Ruben Gallego (D-AZ) and Dave McCormick (R-PA) of a bipartisan

ICYMI: Larson Discusses ‘DOGE’ and Trump-Musk Cuts to Social Security on The Back Room...

This weekend, House Ways and Means Social Security Subcommittee Ranking Member John B. Larson (CT-01) joined The Back Room with Andy Ostroy to discuss Elon Musk’s ‘DOGE,’

Share of Mortgage Loans in Forbearance Decreases Slightly to 0.36% in March

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 2 basis points from 0.38% of servicers’

MBA Statement on the Reintroduction of House and Senate Bills to Stop Abusive Trigger...

MBA's President and CEO Bob Broeksmit, CMB, released the following statement on the reintroduction of the Homebuyers Privacy Protection Act in the U.S. House of Representatives and

HUD Extends Foreclosure Relief to More than One Million FHA Borrowers Recovering from Hurricanes...

U.S. Department of Housing and Urban Development (HUD) Secretary Scott Turner announced the Federal Housing

Avoid Foreclosure: Why Selling to a Cash Buyer Can Save Your Home

Foreclosure is a legal process that allows lenders to reclaim property when homeowners fail to meet their mortgage obligations. It begins when a borrower falls behind on their

MBA Calls on VA and Congress to Implement Permanent Partial Claim Program to Assist...

MBA's President and CEO Bob Broeksmit, CMB, released the following statement on the Department of Veterans Affairs’ (VA) reported plans of a phase-out of its Veterans Affairs Servicing

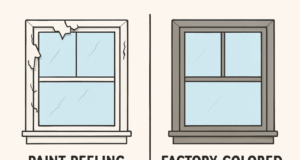

AssetVal and Restb.ai to Modernize Broker Price Opinions with AI-Powered Visual Validation

AssetVal, a valuation industry leader known for delivering high-quality Broker Price Opinions (BPOs), is partnering with Restb.ai, a trusted innovator in computer vision AI for the mortgage

Slight Decline in Rates Helps New Home Sales to Edge Higher in February

A slight decline in mortgage rates and limited existing inventory helped new home sales to edge higher in February even as housing affordability challenges continue to act as a strong

MBA Releases 2024 Rankings of Commercial/Multifamily Mortgage Firms’ Origination Volumes

According to a set of commercial/multifamily real estate finance league tables prepared by the Mortgage Bankers Association

Commercial and Multifamily Mortgage Debt Outstanding Increased in the Fourth Quarter of 2024

The level of commercial and multifamily mortgage debt outstanding at the end of 2024 was $172 billion (3.7 percent)

The Mortgage Broker Process From Start to Finish

The mortgage broker industry plays a key role in the home-buying process. With so many options and regulations, having someone experienced by your side can make a real difference. Brokers act as go-betweens for buyers and lenders, helping clients find loan options that fit their finances.

zavvie Launches HomeFAI: AI-Powered Alternative Financing System Brings Speed and Cash to Win More...

zavvie, a leading fintech company bringing liquidity to residential real estate, has launched an AI powered platform designed to

Mortgage Credit Availability Increased in February

Mortgage credit availability increased in February according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) that analyzes data from ICE