New Freddie Mac Enhancements Give Lenders Greater Certainty While Streamlining Condo Originations

Freddie Mac (OTCQB: FMCC) announced today further enhancements to its Condo Project Advisor® allowing lenders of all sizes to bring greater efficiency to the financing of condominiums. Specifically, in just minutes lenders can determine whether a specific loan to finance the purchase of a condo unit meets Freddie Mac’s guidelines.

Lance F. Drummond Elected Chair of Freddie Mac

Lance Drummond will become chair of Freddie Mac's Board of Directors, the company announced today. A member of the Board since 2015, Drummond will succeed Sara Mathew, who will retire as Board chair and as a Director in February 2024, as required by the company's bylaws.

Freddie Mac Announces Underwriting Innovation to Help Lenders Qualify More Borrowers for a Mortgage

Freddie Mac (OTCQB: FMCC) will increase homeownership opportunities by including a review of a borrower’s bank account data to identify a history of positive monthly cash flow activity as part of its technology’s loan purchase eligibility assessments, the company announced today.

Freddie Mac Takes Further Action to Help Renters Achieve Homeownership

Freddie Mac (OTCQB: FMCC) announced that it will increase homeownership opportunities for first-time homebuyers by considering on-time rent payments as part of the company’s loan purchase decisions. Beginning July 10, 2022, this automated functionality will be available to mortgage lenders nationwide through Freddie Mac Loan Product Advisor® (LPA), the company’s automated underwriting system.

Freddie Mac Announces First Automated Assessment of Direct Deposit Income

Freddie Mac (OTCQB: FMCC) announced today that the company will launch a new, automated capability that allows mortgage lenders to assess a prospective homebuyer’s income paid through direct deposit to reduce the paper documentation burden on borrowers so they can close loans faster and simplify the lending process.

Freddie Mac Research Explores Causes for the Appraisal Valuation Gap for Homeowners in Minority...

Freddie Mac (OTCQB: FMCC) today released an analysis showing that appraisal values are more likely to fall below the contracted sale price of a home in census tracts with a higher share of Black and Latino households, resulting in an appraisal gap. The extent of that gap increases as the percentage of Black and Latino individuals in the census tract increases

Global Market Volatility Pushes Mortgage Rates Lower

Freddie Mac (OTCQB: FMCC) today released the results of itsPrimary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates falling to their lowest levels since May of this year amid substantial and ongoing global volatility out of China.

U.S. Housing Markets Strengthen

Freddie Mac (OTCQB: FMCC) today released its updated Multi-Indicator Market Index® (MiMi®) showing the U.S. housing market continuing to slowly stabilize with two additional states, Arkansas and Tennessee, and four additional metro areas entering their outer range of stable housing activity: Omaha, Nebraska; Scranton, Pennsylvania; Chattanooga, Tennessee and Madison, Wisconsin.

Where Are Future Homebuyers Hiding? In Single-Family Rental Properties

New Freddie Mac (OTCQB: FMCC) research provides insight into the question of which renters are likely to buy a home? The research shows that people renting single-family properties (renting a house/townhouse or condo) may be more likely to buy than those in apartments. In the U.S. about 15 million households rent a single-family house and 25 million rent an apartment, according to U.S. Census Data.

30-Year Fixed-Rate Mortgage Remains Below Four Percent

Freddie Mac (OTCQB: FMCC) today released the results of itsPrimary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates largely unchanged from the previous week amid little movement in financial markets. The 30-year fixed rate mortgage has averaged below four percent for the fifth consecutive week.

Freddie Mac Prices $1.2 Billion Multifamily K-Deal Backed by Seasoned Loans

Freddie Mac (OTCQB: FMCC) recently priced its second K-P Series offering of Structured Pass-Through Certificates (K Certificates) which are multifamily mortgage-backed securities. The company expects to issue approximately $1.2 billion in K Certificates (K-P02 Certificates), which are expected to settle on or about August 27, 2015. The K-P02 Certificates are guaranteed by Freddie Mac and are backed by 70 seasoned multifamily mortgages from the company's retained portfolio. This is the company's seventeenth K Certificates offering this year.

Freddie Mac Guarantees Second Multifamily Small Balance Loan Securitization

Freddie Mac (OTCQB: FMCC) today announced that it will guarantee its second series of SB Certificates, which are backed by multifamily small balance loans underwritten by Freddie Mac and issued by a third-party trust. The company expects to guarantee approximately $109 million in SB Certificates (SB2 Certificates), which are anticipated to price the week of August 24, 2015, and settle on or about August 28, 2015.

Freddie Mac Prices $471 Million Multifamily K-Deal, K-719

Freddie Mac (OTCQB: FMCC) recently priced a new offering of Structured Pass-Through Certificates (K Certificates) which are backed by fixed-rate multifamily mortgages with 7-year terms. The company expects to issue more than $471 million in K-719 Certificates, which are expected to settle on or about August 19, 2015. This is the company's fifteenth K Certificates offering this year.

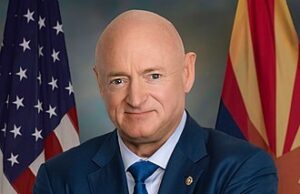

Warner on Executive Pay at Freddie Mac & Fannie Mae

U.S. Sen. Mark R. Warner (D-VA), a member of the Senate Banking Committee and Ranking Member of the Banking Subcommittee overseeing the secondary mortgage market, released a statement after mortgage-finance companies Freddie Mac and Fannie Mae disclosed today that their regulator, the Federal Housing Finance Agency, had authorized them to review the pay of their top executives

Freddie Mac Reports First Quarter 2015 Financial Results

Freddie Mac (OTCQB: FMCC) today reported its first quarter 2015 financial results and filed its quarterly Form 10-Q with the U.S. Securities and Exchange Commission (SEC). The company's SEC filing and press release are available now on the company's website, www.freddiemac.com/investors, along with the first quarter 2015 financial results supplement

Mortgage Rates Up on Mixed Economic and Housing Data

(Marketwired - Apr 30, 2015) - Freddie Mac (OTCQB: FMCC) today released the results of itsPrimary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates slightly higher amid mixed housing and economic reports.

Freddie Mac Reaches the $100 Billion Milestone in Multifamily K-Deal Securitizations

Freddie Mac (OTCQB: FMCC) Multifamily today announces a significant milestone -- it has securitized more than $100 billion of multifamily mortgages through its innovative K-Deal program. By laying off the vast majority of the expected credit losses of the underlying loans to private capital markets, K-Deals reduce the company's credit exposure and taxpayer risk.

Freddie Mac Issues Monthly Volume Summary for March 2015

The summary, available on the company's website at www.FreddieMac.com/investors/volsum, provides information on Freddie Mac's mortgage-related portfolios, securities issuance, risk management, delinquencies, debt activities and other investments

Freddie Mac Makes Single-Family Loan-Level Data Publicly Available to Boost Transparency and Modeling Accuracy

MCLEAN, VA - March 21, 2013 - (RealEstateRama) -- Freddie Mac (OTCQB: FMCC) today announced that it is making available loan-level credit performance data on a portion of the fully amortizing 30-year fixed-rate single-family mortgages the company purchased over the past 13 years. The company is making the single-family performance data available at the direction of its regulator, the Federal Housing Finance Agency (FHFA).

Freddie Mac Extends Mortgage Relief to Borrowers Affected by Mississippi Storms

MCLEAN, VA - March 13, 2013 - (RealEstateRama) -- Freddie Mac's (OTCQB: FMCC) full menu of relief policies for borrowers affected by disaster is being extended to homeowners whose homes were damaged or destroyed by the storms and floods that swept through Mississippi last February and are located in jurisdictions that the President has declared to be Major Disaster Areas and where federal Individual Assistance programs are made available to affected individuals and households. Freddie Mac is one of the nation's largest investors in residential mortgages