The real estate developers and property experts based in Singapore have some good news after enduring a lackluster market for four years. But some of the investors are still doubtful about spending a lot in the private properties. The scenarios for buying a personal home or apartment in Singapore must be discussed for making a quintessential plan.

The Declining Phase

It definitely makes sense to expect the rebounding of prices earlier post the decline of 15 consecutive years. It is simple to compare the past periods with the recent market situation to understand how long would this decline be continued.

| The Decline Period | Total Decline | |

| Financial Crisis 1997 (Asia) | 10/4 | 45 percent |

| Sars Outbreak/Dot-Com Bubble (2000) | 15/4 | 20 percent |

| Major Crisis of Finances (2007) | 4/4 | 25 percent |

| After the Period of Measure | 15/4 | 12 percent |

The recent time of fifteen consecutive quarters of decline has got much time as far as declines are concerned. Instead of experiencing a market crisis, the decline has been induced artificially with the cooling measures. The local government had introduced such cooling measures for ensuring the soft landing and to stop growth in property prices due to speculation.

En Block Fever: All You Need to Know

The big trends in the Singaporean property market (for 2017 and 2018) is said to be as En Block Fever. All the necessary details regarding making investments, hunting for the house in Singapore as a tenant and current prices can be easily found through it. The deals of En Block allow the consistent flow back of money for the successful outcomes. It is assumed that the reinvestment of money shall be seen into the 2018’s market post crossing the $3 billion investment in 2017.

Buyers and their Intentions: What’s the Current Scenario?

Undoubtedly, the majority of potential customers seem more interested in buying properties for personal living purposes despite numerous speculations in the global real estate world. The Number One Property can play vital role to find the best deals for you with the comfort of your couch. Aside from just purchasing the properties, the investors nowadays have numerous ways of entering the market property. There are 108 firms which have been listed as the major investors of real estate sector in Singapore. The forty three professionally administered property trusts or real estate investment trusts can be chosen by the investors to invest.

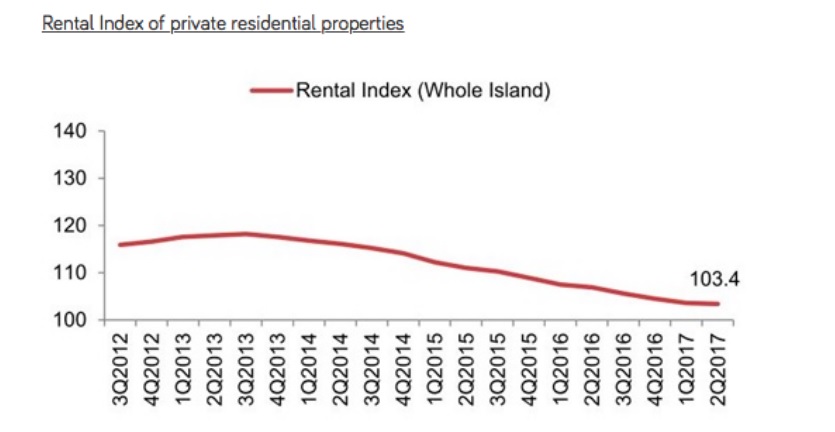

The Weak Demand in Rental Market

It is worth figuring out that the rental market in Singapore is still in declining phase if you’ve planned to invest in the private property for rental income generation.

The Verdict

As the prices have declined, the attractive property market is worth-considering for the personal home stay. But spending the whole-life savings on investment for the residential properties is not a wise move. Now, it’s upon you whether to go for this option or not. Secondly, it is also recommended to keep yourself updated with the latest info about this particular issue.