CFPB Impedes Ability to Ensure All Americans are Fairly Served in the Housing Market by Exempting Companies from Data Reporting

Move Puts Communities of Color, Low- and Moderate-Income Families, and Rural Communities at Risk

WASHINGTON, D.C. – RealEstateRama – The Consumer Financial Protection Bureau (CFPB) yesterday issued a final rule that exempts more than 1,700 additional financial companies from reporting Home Mortgage Disclosure Act (HMDA) data about their lending. HMDA was enacted to combat lending discrimination by requiring companies to report public data on their mortgage lending, including information on borrower race and ethnicity. The reported information is a critical tool for researchers, advocates, and policymakers to track lending disparities and inequality in the housing marketplace.

Center for Responsible Lending (CRL) Executive Vice President Nikitra Bailey issued the following statement:

Especially as we see COVID-19’s devastating impact on communities of color and low-income people, it is deeply disappointing that a federal agency – created to protect consumers – just reduced the availability of data used to combat discrimination in mortgage lending.

Hardworking families have yet to recover from the last recession, and we need more data – not less – to tell us how well they are faring now. Access to mortgage credit is already tightening. HMDA data lets us know if banks are lending to underserved families so that they can become homeowners and build the wealth needed to overcome the recession that we are now starting to experience.

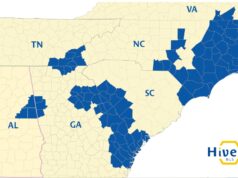

Rural communities, which have also not shared in the prosperity much touted before COVID-19 hit, will be particularly harmed by this new CFPB rule, which will give many lenders a free pass from serving all Americans.

Additional Background

HMDA rulemaking has previously made adjustments for small financial companies that make a small number of mortgages to report this data, but yesterday’s rule goes well beyond that consideration by loosening regulations and undermining the purposes of the law. In 2014, a previous CFPB HMDA rule established a reasonable threshold on the number of loans for reporting while supporting fair lending.

A summary of the final HMDA rule issued yesterday may be found here: https://files.consumerfinance.gov/f/documents/cfpb_hmda_executive-summary_2020-04.pdf.

The full text of the final HMDA rule issued yesterday may be found here: https://files.consumerfinance.gov/f/documents/cfpb_final-rule_home-mortgage-disclosure_regulation-c_2020-04.pdf.

###