How can real estate firms manage expenses effectively

Expense management for a real estate business can be trickier than typical in-office expense management. Real estate agents usually travel to meet clients, and businesses are conducted outside of the office and not from a fixed location. This can make the task of tracking and managing expenses more challenging than expected.

But there is a way to help real estate agents report expenses with ease and make the entire expense management process seamless. Let’s see how.

Why is expense management important for real estate firms?

Business expenses consist of amounts employees spend in order to generate more revenue. By tracking business expenses properly, real estate companies can maintain a healthy cash flow.

Additionally, by streamlining their expense management process, companies can:

- Maximize their tax deductions,

- Keep a clean record of their business expenses, and

- Stay audit-ready, at all times.

What are the types of expenses real estate businesses incur?

Some common business expenses incurred by a real estate business are:

- Advertising costs – Expenses in advertising include digital and print advertisements, website maintenance, mailing lists, brand designing, etc.

- Business travel – As discussed earlier, real estate agents usually travel to meet clients. Their travel expenses include cab, bus, train, fares, tolls, and parking fees.

- Professional fees – This includes mostly recurring fees such as real estate license renewal fee, service fees from other listings, and realtor association fees.

- Insurance – Health insurance, business equipment insurance, business liability insurance, etc., are some of the services businesses pay for. These are securities that a business needs and can help protect them from financial losses.

- Professional service fees – Bookkeeping and accounting tasks are tedious. Most businesses outsource bookkeeping to professionals so that they can focus on their core business and be sure that their books are in order.

Are there any other tax-deductible expenses?

Common expenses can be easy to track, but businesses need to pay special attention to IRS tax rules. For example, business meals and entertainment are 50% deductible. Therefore, it can be more beneficial to take clients to dinner than to give them gifts.

Businesses need to keep tabs on all these expenses along with the receipts. This enables companies to track expenses at the source, thereby ensuring audit readiness at all times.

Let’s look at some of the other tax-deductible expenses real estate agents can incur.

- Home office-related expenses:

If the workplace meets the standards set by the IRS, home office expenses are deductible. For example, if business owners use part of their home for business, they may deduct expenses from it. Other expenses that they can deduct for working from home include home depreciation, business percentage of deductible mortgage interest, utilities, property taxes, homeowners insurance, and home maintenance.

- Mileage deduction:

If business owners or employees use their vehicle for work-related purposes, they can deduct taxes from that as well. The IRS adjusts the mileage rate each year, and the rate can vary upon the type of vehicle as well.

But for employees to claim reimbursement, they have to produce receipts and mileage reports. The mileage report has to provide details such as distance covered, purpose, date of travel, and the start and end destination.

How can an expense management software help?

Manually reporting, tracking, and managing expenses can be very tiresome. Issues such as missing receipts, incomplete expense reports, or data entry errors can also occur.

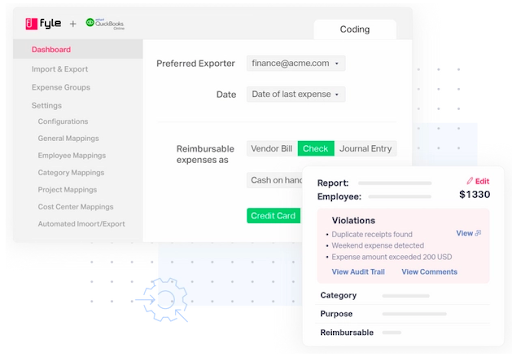

But by investing in an automated expense management software, such as Fyle, businesses can eliminate issues that come with manual expense management. Additionally, they can streamline their entire expense reporting and management processes, enforce efficiency, and increase productivity.

Expense management software comes with several features that can truly automate every step of the process. Let’s take a look at some of them:

- Receipt scanning:

Real estate agents can easily download and install expense management software apps on their mobile devices. The app comes equipped with a receipt scanning feature that allows users to capture and scan paper receipts on-the-go. This enables users to digitize their receipts and eliminate any chances of losing or misplacing them.

- Mileage tracking:

An expense management software empowers users to track their business trips with more accuracy and less hassle. The software automatically calculates miles covered by the employees along with the applicable standard mileage rate. It also enables traveling employees to provide a detailed expense report of their trip and reduces any chances of errors.

![]()

- Unlimited cloud storage:

An expense management software comes with a centralized cloud storage space that stakeholders can access at any time. Additionally, all receipts, bills, invoices, and expense reports are safely stored on the cloud. This eliminates the chances of documents getting lost or having to wait on someone to access expense records. Through cloud storage, employees can also get updates on their reimbursements, eliminating the need to go back and forth with finance teams.

- Credit card reconciliation:

The process of credit card reconciliation can be time-consuming and tedious. But an expense management software automates the entire process. The software auto-matches every expense with its transaction details and eliminates the need for manual intervention.

Using the software, businesses can also:

- Manage multiple card programs,

- Get direct bank feeds,

- View card spends, and

- Automate reminders for employees to submit receipts for spends.

- Direct integration with accounting software:

With an expense management software, businesses can keep their books updated and always stay audit-ready. The software allows companies to integrate directly with their favorite accounting software and sync expense data in real-time. This also makes it easier for businesses to export their expense data seamlessly with zero manual efforts.

Conclusion

Effectively managing expenses can prove to be beneficial for realtors and real estate agents. They can maximize tax deductions and have their business finances in order. But with manual expense management, it can be time-consuming and taxing.

Real estate businesses can tackle their expense management challenges with an expense management software. The software comes packed with features that can benefit and align with their needs. Through automation, realtors can save both time and money while focusing on addressing their clients’ needs.