Is it a Good Time to Consider Canadian Real Estate for an Investment Property?

There is nothing as thriving as the real estate market industry. More real estate markets arising worldwide is the reason behind the intense competition experienced in terms of growth. If you want to invest in the real estate, now would be a better time to start planning. The proper investment ensures long-term growth and stable residual earnings from a property.

Also, the high demand for holiday rentals today has made the real estate market more attractive. Sometimes first-timers can experience difficulties when it comes to discovering the foreign market. However, there are still numerous opportunities in specific countries to take advantage of without much strain. In this article, we shall emphasize on matters concerning the real estate market in Canada to novel and experienced investors.

Identifying the Right City

Canada has some protocols that govern foreign property in specific cities hence selecting the city you want to invest in is significant. You also have to understand the city rules to take care of your investments in terms of costs. Most people prefer the city of Toronto as an investment destination when it comes to real estate. For example, you won’t need the foreign buyer tax; therefore, you can save some of your returns. However, properties in Vancouver have charges for international buyers. In other words, any sold property to a foreigner must involve payable tax.

Funding Options

Real estate investment offers numerous financing opportunities and The Canadian housing market is once again looking attractive to US investors in areas of travel, business and tourism. For instance, you can receive mortgages from the Canadian and US banks. However, you must be a US citizen for you to obtain loans from US banks to buy property in Canada. You need a good credit score from a bank to get the loan amount of your choice to enjoy the multiple offers in the real estate market. Also, you need a healthy portfolio to lower the mortgage cost significantly. There are also other options like buy-to-let mortgages with lower rates for those using their personal properties.

Security

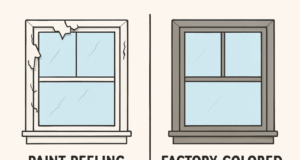

There is no good feel as visiting your properties often. For example, a city like Toronto receives many daily flights which enables you to visit your property frequently. You should always check your investments to be sure everything is going well according to plan. Also, have home insurance as an added security to your investment, especially if the property is in a foreign country. A platform like Airbnb helps in renting out properties to long-term tenants, and they take care of everything like advertising your property to potential tenants. Airbnb handles cleaning, and changing beddings before tenants occupy the property.

Final Thought

In Canada, real estate investment is an exciting process with fewer challenges. Ensure you know the closing cost if you have the mind of purchasing a property in Canada. You need to cover the closing price in case of any property purchase. When I say closing cost, I mean home inspection costs, legal fees, duties, and so on. With several guidelines covered in this article, you will be able to calculate costs attached to the property you are planning to buy in Toronto or other cities.