Marketing & Statistics

RealEstateRama Marketing & Statistics

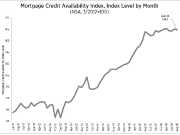

Mortgage Credit Availability Decreases in August

Mortgage credit availability decreased in August according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) which analyzes data from Ellie Mae's AllRegs® Market Clarity® business information tool.

U.S. Solar Market Adds More Than 2 GW in Q2 2016

Growing 43 percent year over year, the U.S. saw 2,051 megawatts (MW) of solar photovoltaic (PV) installed in the second quarter of 2016. According to GTM Research and the Solar Energy Industries Association’s (SEIA) latest U.S. Solar Market Insight report, this marks the eleventh consecutive quarter in which more than a gigawatt (GW) of PV was installed.

Mortgage Applications Slightly Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.9 percent from one week earlier, according to data from the Mortgage Bankers Association's (MBA) Weekly Mortgage Applications Survey for the week ending September 2, 2016.

CONSTRUCTION SPENDING REMAINS STEADY IN JULY AND IS UP BY 5.6 PERCENT FOR THE...

Private-Sector Outlays Rise 1.0 Percent for the Month While Public Sector Investments in Infrastructure, Other Construction Fall 3.1 Percent as New Survey Finds Most Firms Having Hard Time Finding Craft Workers

Commercial/Multifamily Delinquencies Remain Low in Second Quarter

Delinquency rates for commercial and multifamily mortgage loans remained low in the second quarter of 2016, according to the Mortgage Bankers Association's (MBA) Commercial/Multifamily Delinquency Report.

Independent Mortgage Banks’ Profits Double in 2nd Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $1,686 on each loan they originated in the second quarter of 2016, up from a reported gain of $825 per loan in the first quarter of 2016, the Mortgage Bankers Association (MBA) reported today in its Quarterly Mortgage Bankers Performance Report.

Pending Home Sales Tick Up in July

Pending home sales expanded in most of the country in July and reached their second highest reading in over a decade, according to the National Association of Realtors®. Only the Midwest saw a dip in contract activity last month

Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.8 percent from one week earlier, according to data from the Mortgage Bankers Association's (MBA) Weekly Mortgage Applications Survey for the week ending August 26, 2016.

Commercial Real Estate Expansion Foreseen

Buoyed by a steadily improving labor market and strong demand for multifamily housing, commercial real estate activity should remain on an upward trajectory, with a growing share of it is expected to be in smaller markets, according to the National Association of Realtors® quarterly commercial real estate forecast.

Existing-Home Sales Lose Steam in July

Slowed by frustratingly low inventory levels in many parts of the country, existing-home sales lost momentum in July and decreased year-over-year for the first time since November 2015, according to the National Association of Realtors®. Only the West region saw a monthly increase in closings in July.

Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.1 percent from one week earlier, according to data from the Mortgage Bankers Association's (MBA) Weekly Mortgage Applications Survey for the week ending August 19, 2016.

CONSTRUCTION EMPLOYMENT RISES IN 39 STATES AND THE DISTRICT OF COLUMBIA OVER LATEST 12...

Thirty-nine state added construction jobs between July 2015 and July 2016 while construction employment only increased in 23 states and the District of Columbia between June and July, according to analysis of Labor Department data released today by the Associated General Contractors of America. Association officials said construction employment likely declined in many states as firms have growing difficulty locating qualified workers to hire.

Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 4.0 percent from one week earlier, according to data from the Mortgage Bankers Association's (MBA) Weekly Mortgage Applications Survey for the week ending August 12, 2016.

Delinquencies and Foreclosures Continue to Drop

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased 11 basis points to a seasonally adjusted rate of 4.66 percent of all loans outstanding at the end of the second quarter of 2016. This was the lowest level since the second quarter of 2006. The delinquency rate was 64 basis points lower than one year ago, according to the Mortgage Bankers Association's (MBA) National Delinquency Survey.

Applications for New Home Purchases See Year over Year Increase in July

The Mortgage Bankers Association (MBA) Builder Applications Survey (BAS) data for July 2016 shows mortgage applications for new home purchases increased 2.4 percent relative to a year ago. Compared to June 2016, applications decreased by 8 percent. The month over month change does not include any adjustment for typical seasonal patterns.

Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 7.1 percent from one week earlier, according to data from the Mortgage Bankers Association's (MBA) Weekly Mortgage Applications Survey for the week ending August 5, 2016

Atlanta is one of the healthiest office markets in the world, based on the...

Office rents jumped 13 percent, placing Atlanta at No. 8 in JLL’s Global Top 10 market for office growth. In JLL’s Global Office Index report, Oakland East Bay, Stockholm, Dublin and Dubai (DIFC) took the top spots for annual office rental growth, all with growth of 20 percent or more. Apart from Oakland East Bay, and Atlanta, two other U.S. cities were featured in the top ten: Los Angeles (seventh) and Austin (ninth) showing 13.5 and 12.1 percent growth respectively.

New Waste Tracking Feature Helps Building Managers Save Money and Support a Healthy Environment

Building managers can now track energy, water, greenhouse gas emissions and waste together in Energy Star’s Portfolio Manager

WASHINGTON - (RealEstateRama) -- The U.S. Environmental...

Mortgage Credit Availability Increases in July

Mortgage credit availability increased in July according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) which analyzes data from Ellie Mae's AllRegs® Market Clarity® business information tool. Starting this month, MBA has updated its methodology to better measure credit availability and has released a new historical series based on this updated methodology. As part of this change the Conforming and Jumbo MCAIs have been updated to only include conventional, non-government loan programs

NAR Identifies Top Markets Where Renters Can Afford to Buy

The U.S. homeownership rate has slowly fallen in recent years to currently its lowest level since 19651, but new research from the National Association of Realtors® reveals that there are affordable metro areas right now with above-average hiring and a large segment of current renters who earn enough income to qualify to buy a home.