Realtors(R) Urge President To Sign Tax Relief Bill Quickly To Ease Foreclosure Burdens

WASHINGTON, December 18, 2007 – Many families and individuals are one step closer to seeing tax relief, thanks to the passage of the Mortgage Cancellation Tax Relief Act by the U.S. Senate and House of Representatives, according to the National Association of Realtors®. Since the early 1990s, NAR has advocated repealing the current law that forces individuals to pay an income tax when they have had a loan forgiven in either a foreclosure, a sale in a market where prices are declining or because the lender grants new mortgage terms.

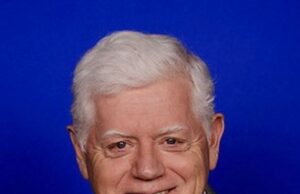

“In sending this bill to the president, Congress made a good decision today that will affect many Americans who find themselves in a truly bad situation,” said NAR President Richard Gaylord, a broker with RE/MAX Real Estate Specialists in Long Beach, Calif. “As the leading advocate for housing issues, NAR believes that changing the IRS code is an issue of fundamental fairness. It will relieve a tax burden at a time when an individual or family has experienced a true economic loss arising from the sale or loss of their home. These people are already in financial distress and are most likely unable to pay additional taxes.”

NAR is committed to continuing efforts to make the horror of losing a home less burdensome for families. “This is not only about the subprime turmoil we are currently experiencing. This is about families where job loss, divorce, health issues, a drop in the value of the home or other unfortunate circumstances have caused them to lose their home or have to sell that home for less than the amount owed. Clearly, it is unfair to tax people on a phantom income when they most likely have no cash with which to pay the tax,” said Gaylord.

The current tax code requires a lender who forgives debt to provide a Form 1099 to the IRS stating the amount the borrower has been forgiven. This disclosure applies whether it is a short sale, foreclosure, deed in lieu of foreclosure or any similar arrangement that relieves the borrower of the obligation to pay some portion of their debt. If the property is sold at foreclosure or is sold for less then was borrowed, that difference is considered income and is subject to the tax.

The Mortgage Cancellation Tax Relief Act would ensure that any debt forgiven on any mortgage debt secured by a principal residence will not be taxed. The legislation includes a provision to safeguard against abuses. The provision, similar to one that already exists for commercial real estate owners, would treat commercial and residential property equally.

“Realtors® are about building communities, not just selling homes. We must work together to prevent the dream of homeownership from becoming a nightmare,” said Gaylord. “This is just one step that will help families get on with their lives and begin rebuilding their economic security. As the president has been a proponent for this change, we hope he will quickly sign this bill into law.”

The National Association of Realtors®, “The Voice for Real Estate,” is America’s largest trade association, representing more than 1.3 million members involved in all aspects of the residential and commercial real estate industries.