Washington DC – April 10, 2014 – (RealEstateRama) — Earlier today, Rep. Mark Takano hosted a briefing for Congressional staff on the issue of rental-backed securities, institutional investors in the home buying market and the potential consequences.

Sarah Edelman, Policy Analyst for Housing and Finance for the Center for American Progress, Ben Hellweg, Head of Acquisitions for Hyperion Homes, and Sam Khater, Deputy Chief Economist for CoreLogic joined Representative Takano and participated in a panel discussion.

During the event, Takano said, “It’s important for Congress to take its responsibility [seriously], in terms of oversight, and begin to understand these financial instruments and the phenomenon of investor owned properties that are growing across the country.”

Sam Khater from CoreLogic commented on the size of the market and its impact saying, “Several of the questions we get all the time is, ‘How big is this market? Do they have an impact?’ From a national perspective, the impact is small, but from a local perspective, the impact is fairly large. And from a price perspective, there is definitely an impact, especially in some of the markets where they [investors] are particularly active.”

Sarah Edelman from the Center for American Progress discussed potential consequences of the rental-backed securities saying, “If bond holders stopped receiving their payments, they have a few tools. They can foreclose on the homes, because they do have mortgages on them or they can foreclose on what’s called the ‘equity pledge,’ which basically allows them to take over operations of the borrower. They take over the [operations of the] borrower, they can decide either to continue to rent out the properties or sell them or do some combination of both of those things.”

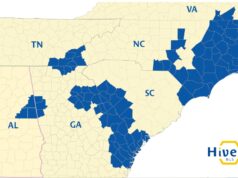

Background Information: In the wake of foreclosure crisis, large investment companies saw an opportunity to purchase less expensive properties and rent them to make a profit. They began buying distressed properties in states like California, Nevada, Florida, Arizona, Georgia, and others. Using their cash advantage, these large investment companies participated in bulk sales and bought thousands of properties across the country. There are an estimated 200,000 investor-owned properties across the country worth a total of $20 billion. Many of these properties are clustered in cities like Riverside, Phoenix, Sacramento, Tampa, Miami, Orlando, and Atlanta.

Now, these same investors are developing new financial products called single family rental backed securities. These bonds are linked to the rental payments from the properties, and bondholders are paid back with interest with the revenue from rental payments.