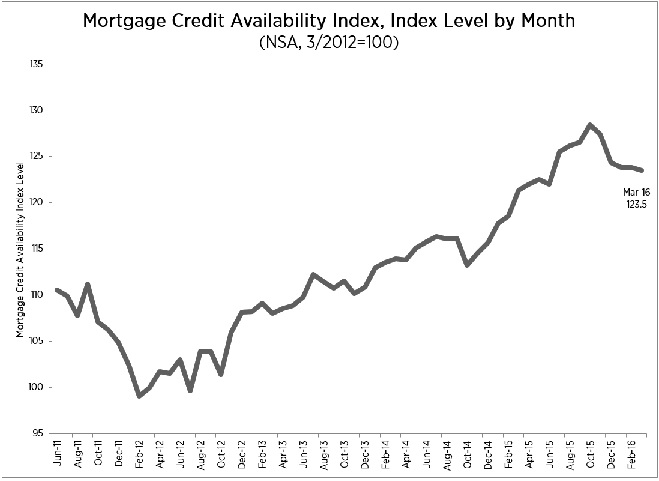

WASHINGTON, D.C. – April 8, 2016 – (RealEstateRama) — Mortgage credit availability slightly decreased in March according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) which analyzes data from Ellie Mae’s AllRegs® Market Clarity® business information tool.

The MCAI decreased 0.2 percent to 123.5 in March. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012. Of the four component indices, the Government MCAI saw the greatest loosening (up 0.9 percent) over the month while the Conventional MCAI saw the most tightening (down 1.6 percent). The Jumbo MCAI decreased 0.2 percent, while the Conforming MCAI decreased 0.4 percent over the month.

“On net mortgage credit availability tightened very slightly in March. Administrative changes drove declines in the availability of conventional and super conforming loan programs, and those were partially offset by slightly relaxed lending standards on government lending programs which includes FHA, VA, and RHS,” said Lynn Fisher, MBA’s Vice President of Research and Economics.

Total Mortgage Credit Availability Index August 2015

Source: Mortgage Bankers Association; Powered by Ellie Mae’s AllRegs® Market Clarity®

CONVENTIONAL, GOVERNMENT, CONFORMING, AND JUMBO MCAI COMPONENT INDICES

MBA now reports on five total measures of credit availability as part of the monthly MCAI release: the Total Mortgage Credit Availability Index, the Conventional Mortgage Credit Availability Index, the Government Mortgage Credit Availability Index, the Conforming Mortgage Credit Availability Index, and the Jumbo Mortgage Credit Availability Index, with historical data back to 2011.

Of the four component indices, the Government MCAI saw the greatest loosening (up 0.9 percent) over the month while the Conventional MCAI saw the most tightening (down 1.6 percent). The Jumbo MCAI decreased 0.2 percent, while the Conforming MCAI decreased 0.4 percent over the month.

Conventional MCAI June 2015 Government MCAI June 2015

Conforming MCAI June 2015 Jumbo MCAI June 2015

Source: Mortgage Bankers Association; Powered by Ellie Mae’s AllRegs® Market Clarity®

The Conventional, Government, Conforming, and Jumbo MCAIs are constructed using the same methodology as the Total MCAI and are designed to show relative credit risk/availability for their respective index. The primary difference between the total MCAI and the Component Indices are the population of loan programs which they examine. The Government MCAI examines FHA/VA/USDA loan programs, while the Conventional MCAI examines non-government loan programs. Similarly, the Jumbo MCAI examines everything flagged as “Jumbo” while the Conforming MCAI examines loan programs that fall under conforming loan limits.The Conforming and Jumbo indices have the same “base levels” as the Total MCAI (March 2012=100), while the Conventional and Government indices have adjusted “base levels” in March 2012. Using data from the MCAI and the Weekly Applications Survey, MBA calibrated the Conventional and Government indices to better represent where each index might fall in March 2012 (the “base period”) relative to the Total=100 benchmark.

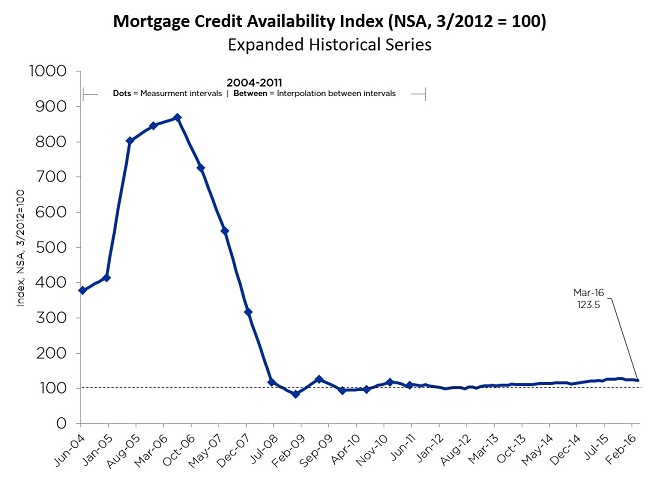

EXPANDED HISTORICAL SERIES

The Total MCAI has an expanded historical series which gives perspective on credit availability going back approximately 10-years (expanded historical series does not include Conventional, Government, Conforming, or Jumbo MCAI). The expanded historical series covers 2004 through 2010, and was created to provide historical context to the current series by showing how credit availability has changed over the last 10 years – this includes the housing crisis and ensuing recession. Data prior to March 31, 2011, was generated using less frequent and less complete data measured at 6-month intervals and interpolated in the months between for charting purposes.

Total Expanded Historical MCAI June 2015

Source: Mortgage Bankers Association; Powered by Ellie Mae’s AllRegs® Market Clarity®

ABOUT THE MORTGAGE CREDIT AVAILABILITY INDEX

The MCAI provides the only standardized quantitative index that is solely focused on mortgage credit.

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for over 95 lenders/investors are combined by MBA using data made available via the AllRegs® Market Clarity® product and a proprietary formula derived by MBA to calculate the MCAI, a summary measure which indicates the availability of mortgage credit at a point in time. Base period and values for total index is March 31, 2012=100; Conventional March 31, 2012=69; Government March 31, 2012=222.To learn more about the AllRegs Market Clarity platform click here.

For more information on the Mortgage Credit Availability Index, including Methodology, Frequently Asked Questions and other helpful resources, please click here or contact .

CONTACT

Ali Ahmad

(202) 557- 2727