After the Short Sale: Taxing What Isn’t There

Too often, real estate practitioners are unaware of the tax liabilities arising from the cancellation of debt and fail to advise their clients accordingly.

You’ve just spent several stressful weeks helping your beleaguered seller negotiate a short sale. You’ve helped demonstrate to the lender that the home’s price has fallen and that to close the deal with the new buyer, the lender will have to forgive $10,000 of the seller’s outstanding mortgage loan not covered by the sale proceeds. But you did it, and now everyone is happy. The buyer gets a home, the lender avoids a messy foreclosure, and the seller walks away with no further financial burdens. Well, not quite.

Whenever real estate is sold, whether in a standard transaction, a short sale or a foreclosure auction, there are potential tax consequences for the seller. In this little scenario, the seller may still owe taxes to Uncle Sam — both in the form of capital gains on the home and on the unpaid portion of the mortgage. Yet, too often, real estate practitioners are unaware of the tax liabilities arising from the cancellation of debt and fail to advise their clients accordingly. Don’t make that mistake with your clients.

How Debt Forgiveness Works

With a short sale, the lender has three possible ways to handle the deficiency balance, which is the portion of the mortgage debt not covered by the sale of the home. First, the lender can attempt to collect the deficiency balance from the seller after the property has closed. Second, the lender may require the seller to sign an unsecured promissory note for the deficiency balance as a condition of agreeing to the short sale. If the new note is for less than the balance of the original debt, the difference would be considered canceled, or forgiven, debt. Third, the lender may agree to cancel the entire deficiency balance.

On the surface, option three would be seem to be the best alternative for a seller. However, the IRS considers any canceled mortgage debt ordinary income. This means that the amount forgiven is taxed at the same rate — somewhere between 15 percent and 30 percent — as the sellers’ salaries. In addition, because the IRS requires the lender to file a 1099-C form stating the amount of the canceled debt, Uncle Sam will have a record of the exact amount of the debt that was cancelled. A seller will also receive a copy of the 1099-C to use in filing income taxes. The seller’s home state would also consider the cancelled debt as ordinary income.

4 Exceptions to the Rule

The IRS does recognize four situations in which cancellation of debt will not result in tax liability for the seller. A seller may avoid tax liability:

- When the borrower receives a bankruptcy discharge and the deficiency was included in the bankruptcy

- When the borrower is insolvent at the time of the cancellation of the debt. Insolvency would occur when a borrower’s liabilities exceed assets. Note that seller would have to prove this insolvency to the IRS when filing a tax return.

- When the debt was secured by a nonrecourse loan. Under a nonrecourse loan, the lender does not have the legal right to collect a deficiency judgment from any assets of the debtor not pledged to secure the loan. While most home mortgages are do not fall into this category, purchase money loans on a person’s residence are nonrecourse in some states.

- When the tax liability from the cancellation of debt on an investment property can be offset against other business liabilities and expenses. This exception does not apply to properties occupied as a residence by the mortgagor.

In many short sales, a seller would be able to qualify under the first two of these exemptions, especially since it was almost certainly necessary to show financial hardship in order to convince the lender to agree to a short sale. However, it is the seller’s responsibility to notify the IRS why the amount in the 1099-C should not be counted as ordinary income. Otherwise, the IRS will consider the forgiven debt as income and penalize the seller for unpaid taxes.

What to Tell Clients

To ensure that your sellers don’t run afoul of the IRS and blame you, you should notify all sellers in writing that they should seek professional tax advice regarding the possible tax consequences of selling their home.

While you certainly don’t want to give specific tax advice, you should also alert short sellers to the basic facts about the tax consequences of short sales. With the current foreclosure crisis in this country, many, including NAR, are working to reverse this law. However, until that time, real estate sales associates must be aware of the potential tax issues for a seller in a short sale

Editor’s note: The NATIONAL ASSOCIATION OF REALTORS® has long worked to change the tax laws and eliminate this “phantom tax on income. Currently NAR is supporting the passage of S. 1394, the Mortgage Cancellation Tax Relief Act, which would repeal the law that requires home owners to pay taxes on forgiven debt for their principal residents as part of a short sale or foreclosure. Learn more about this topic at REALTOR.org.

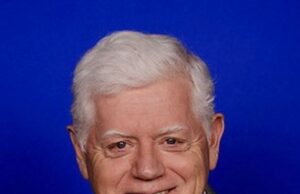

About the Author: Lance Churchill is vice president of FrontLine Seminars, which educates and certifies real estate practitioners in foreclosure, preforeclosure, and short sales. Visit the company’s Web site for information about courses on foreclosures and short sales. It’s blog, Roman”>FrontlineForeclosureForum.com, includes a discussion board for real estate practitioners working with foreclosures and short sales. Churchill can be reached at 208/846-9644 or ">.

By LANCE CHURCHILL, REALTOR® Magazine Online