All USA

Three of Four Major Investor Groups Increased Commercial/Multifamily Mortgage Investments During The Third Quarter

Washington, DC - December 16, 2011 - (RealEstateRama) -- The level of commercial/multifamily mortgage debt outstanding was essentially unchanged in the third quarter of 2011, as three of the four major investor groups increased their holdings, according to the Mortgage Bankers Association (MBA).

ENCELIUM’S NEW POLARIS 3D™ LIGHTING CONTROL SOFTWARE APPLICATION AVAILABLE ON DECEMBER 15

DANVERS, MA - December 16, 2011 - (RealEstateRama) -- Encelium’s Polaris 3D™, a first software application of its kind in the lighting control industry, will be available to new and existing customers on December 15, announced Terry Mocherniak, director global business development for the LMS business unit. Polaris 3D is the next generation of lighting control software for Encelium’s Energy Control System™ (ECS). It is a web based application that provides users with a single 360°, three-dimensional navigation in a multi-floor view of the entire facility’s lighting energy use.

SEC Halts Father-Son Ponzi Scheme in Utah Involving Purported Real Estate Investments

Washington, D.C. - December 16, 2011 - (RealEstateRama) -- The Securities and Exchange Commission today charged a father and son in Utah with securities fraud for selling purported investments in their real estate business that turned out to be nothing more than a wide-scale $220 million Ponzi scheme.

Clean Houses Generate Cleaner Renters

Outer Banks, NC - December 16, 2011 - (RealEstateRama) -- After showing thousands of vacation rental homes on the Outer Banks to prospective buyers over the past 22 years there are some common traits that become obvious. One of these common denominator...

CBRE AWARDED “BROKER DEAL OF THE YEAR” FOR INDUSTRIAL AT NAIOP BEST OF THE...

Tampa, FL - December 16, 2011 - (RealEstateRama) -- By overcoming the challenges of the current market conditions and positively impacting today’s greatest economic indicator, job growth, NAIOP Tampa Bay awarded CBRE ‘Broker Deal of the Year’ in ...

Voting Now Open for 2011 EnergyValue Housing Award People’s Choice

Upper Marlboro, MD - December 16, 2011 - (RealEstateRama) -- Now’s the time to vote for your favorite among this year’s 17 EnergyValue Housing Award finalists – the voting site for the “People’s Choice” award is up and running.

Community Associations Institute Honors Merit’s Inland Empire Manager Kristie Rose with Award

Inland Empire, CA - December 15, 2011 - (RealEstateRama) -- Merit Property Management, a FirstService Residential Management company, announces today that Kristie Rose, PCAM, CCAM, Merit’s Inland Empire Business Unit Leader, was honored with the indu...

California home sales and median price post increases in November, C.A.R. reports

LOS ANGELES, CA - December 15, 2011 - (RealEstateRama) -- California home sales posted an increase both on a monthly and annual basis in November, marking the fifth consecutive month of year-to-year sales increases, according to figures released today ...

A Growing Cushman & Wakefield | Cornerstone Moves To Maryland Farms

Nashville, TN - December 15, 2011 - (RealEstateRama) -- Cornerstone Commercial Real Estate Services, a Cushman & Wakefield Alliance member, is starting the New Year in a new office. Due to the expansion of the firm, Cornerstone will be moving from...

DIVERSIFIED CAPITAL ADDS NEW AMENITIES TO MULTI-MILLION-DOLLAR RENOVATION OF 24 COMMERCE STREET

NEWARK, N.J. - December 15, 2011 - (RealEstateRama) -- Diversified Capital has added a broad suite of new tenant amenities being implemented at 24 Commerce Street, the former Federal Trust Bank building in downtown Newark. These new amenities, along wi...

South Carolina REALTORS® release November Market Numbers

COLUMBIA, S.C. - December 15, 2011 - (RealEstateRama) -- South Carolina REALTORS® (SCR) today released its November 2011 statewide market reports. Home prices are one of the most popular barometers of market vitality, yet they only tell part of the st...

Mitigation Tips to Build Fire-Resistant Homes

AUSTIN, TX - December 15, 2011 - (RealEstateRama) -- Though the embers from the Texas wildfires have cooled, many survivors in the 23 affected counties still face the heavy task of rebuilding. With a new wildfire season under way, now is the time to re...

FTC Settlement Requires “U.S. Homeowners Relief” Defendants to Pay Millions, Bans Them from Debt...

WASHINGTON, D.C. - December 15, 2011 - (RealEstateRama) -- Six defendants have agreed to settle Federal Trade Commission charges that they participated in a fraudulent mortgage modification and foreclosure relief scheme. The settlement orders require five defendants to pay back millions in ill-gotten gains, and permanently ban all six from selling any mortgage assistance or debt relief products. The settlements with the U.S. Homeowners Relief defendants are part of the agency’s ongoing crackdown on frauds targeting consumers in financial distress.

Lila Delman Real Estate Announces the Sale of the Horatio N. Campbell House

December 15, 2011 - (RealEstateRama) -- Lila Delman Real Estate announced the sale of the Horatio N. Campbell House, a landmark property on the East Side of Providence. The home at 189 Hope Street is an 8000 square French inspired mansion with 10 bedrooms and 5 bathrooms. Lila Delman Real Estate sales associates Lisa Cutropia and Ben Scungio represented the buyer.

Duck Oceanfront Home Absorption Rate

Outer Banks, NC - December 15, 2011 - (RealEstateRama) -- The recession seems to be affecting different segments of the population differently. While all we ever hear about are the people who lost their jobs and who lost their houses and trashed their ...

CUSHMAN & WAKEFIELD ARRANGES 146,500-SQUARE-FOOT LEASE WITH FRY COMMUNICATIONS

NEW KINGSTOWN, PA - December 15, 2011 - (RealEstateRama) -- Fry Communications Inc. has signed a new full-building lease for 146,500 square feet at 36 East Main Street, a one-story industrial facility owned by Seagis Property Group. The landlord was re...

FHFA Announces New Timeline for Fannie Mae and Freddie Mac Mortgage Data Implementation

Washington, DC - December 15, 2011 - (RealEstateRama) -- The Federal Housing Finance Agency (FHFA) today said it will extend implementation dates for a key component of the Uniform Mortgage Data Program (UMDP) announced in May 2010, known as the Uniform Loan Delivery Dataset (ULDD).

Community Investment Strategies Takes the Solar Power Plunge

LAWRENCEVILLE, N.J. - December 15, 2011 - (RealEstateRama) -- Community Investment Strategies (CIS), Inc., the developer, builder and property manager of market-rate and affordable apartment-rental communities throughout New Jersey, has adopted sol...

CONSTRUCTION MATERIALS PRICES INCH DOWN IN NOVEMBER BUT CONTINUE TO OUTRUN YEAR-OVER-YEAR BUILDING PRICES,...

WASHINGTON, D.C. - December 15, 2011 - (RealEstateRama) -- The amount contractors pay for a range of key construction materials edged down 0.1 percent in November but climbed 6.2 percent from a year earlier, outstripping the increase in contractors’ bid prices for finished buildings, according to an analysis of producer price index figures released today by the Associated General Contractors of America. Officials with the construction association warned that the cost squeeze on contractors, combined with declining public sector investments in construction, may drive many contractors out of business.

Mortgage Forgiveness Debt Relief Act Expires Dec 31 2012!

Las Vegas, NV - December 15, 2011 - (RealEstateRama) -- If you’ve been thinking about doing a short sale on your Nevada home, you might want to hurry up. The time is limited for homeowners who want to ensure they aren’t hit with a big tax bill beca...

U.S. National

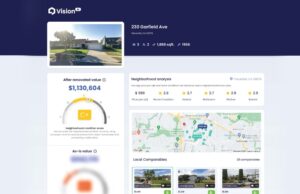

Revive Adds First-of-its-Kind Neighborhood Report Feature to Vision AI, Transforming Real Estate Valuations with...

Most homeowners understand that updating and renovating their home could help them earn more money at its sale, but because

Making the Most of the Summer Moving Season as a Home Buyer

As the temperatures rise and the days grow longer, the real estate market heats up along with the weather. Summer marks the peak season for moving, and for home buyers, it presents a unique opportunity to capitalize on various factors that make the process smoother and more rewarding.

Essential Plumbing Checks Before Buying a Home

When embarking on the exciting journey of buying a home, it's easy to be swept off your feet by a charming facade or an inviting interior. However, it's crucial to look beyond the surface

GFP Real Estate and Its Tenants Raise More Than $200,000 to Support Ukrainian Refugees

GFP Real Estate is pleased to announce that its "Support Ukraine in Crisis" campaign raised more than $200,000 to support humanitarian relief efforts on the ground in Ukraine.

SWALWELL, HAYES & HEINRICH INTRODUCE BILL TO MAKE HOUSING MORE AFFORDABLE FOR TEACHERS

U.S. Representatives Eric Swalwell (D-CA) and Jahana Hayes (D-CT) today introduced the Educator Down Payment Assistance Act

National Housing Conference applauds FHFA’s new rule enhancing fairness in the housing finance sector

The National Housing Conference’s (NHC) President and CEO David M. Dworkin released the following statement in response to

HUD Announces Co-Presenters for the 2024 Innovative Housing Showcase

The U.S. Department of Housing and Urban Development (HUD) announced the International Code Council (ICC), the Manufactured Housing Institute (MHI), the National Multifamily

Elevate Your Cooking Experience: Benefits of Glass Splashbacks

In the realm of interior design, the kitchen holds a special place. It's not just a place for preparing meals; it's a space where functionality meets aesthetics. Among the various elements that contribute to the allure of a kitchen, the splashback stands out as both a practical and stylish addition.

MHP Launches Bold Campaign to Double Affordable Housing

Nonprofit affordable housing developer MHP has officially launched a bold new $20M campaign to double its impact by the end of the decade, activating a plan to expand and preserve more affordable housing in Montgomery County, MD and across the DMV. As of today, MHP has raised $15.8M, 79% of its goal.

Kelly Ballinger wrote her name on rent payments, altered renters’ incomes to steal funds

PORTLAND, Maine: A Glenburn woman pleaded guilty in U.S. District Court in Portland to embezzling from an organization receiving federal funds and conspiring to alter money orders. According to court records, Kelly Ballinger, 57, was a former property manager for a Portland apartment complex with residences funded by the Department of Housing and Urban Development (HUD).

NAHB Announces a 10-Point Plan to Tame Shelter Inflation, Ease the Housing Affordability Crisis

With a nationwide shortage of roughly 1.5 million housing units that is making it increasingly difficult for American families to

USGBC Joins Group Celebrating Updated Energy Efficiency Rules for New U.S.-Backed Homes

The U.S. Green Building Council (USGBC), the leading authority on green building and the global developer of the LEED green building program, joined advocates and industry groups today in

More Than 90% of Metro Areas Recorded Home Price Increases in First Quarter of...

More than 90% of metro markets (205 out of 221, or 93%) posted home price gains in the first quarter of 2024, as the 30-year fixed mortgage rate ranged from 6.60% to 6.94%, according

Revive CTO Mansoor Bahramand Named 2024 “Future Leader in Real Estate”

Revive, the leading provider of pre-sale home renovation solutions, announced that Mansoor Bahramand, its Chief Technology Officer, has been named a 2024 “Future Leader in

How Great Landscaping Can Help Boost Home Property Value

A home's value is determined by several elements, and landscaping is important for improving a property's curb appeal and overall attractiveness. Well-designed landscaping, such as verdant gardens, tidy lawns, and eye-catching outdoor living areas, may dramatically raise a home's value.

Breathing Life Back into Your Lawn: A Guide to Lawn Care Aeration

Dallas lawns face a unique set of challenges. The hot Texas summers, coupled with compacted soil from regular foot traffic and heavy clay content in some areas, can lead to compacted soil, hindering air, water, and nutrient penetration to the grassroots. This results in a stressed lawn that's more susceptible to disease, pests, and poor growth.

Statement of Jeffrey Weidell, CEO of Northmarq and MBA 2024 COMBOG Chair, on Commercial...

Jeffrey Weidell, CEO of Northmarq and 2024 Mortgage Bankers Association (MBA) COMBOG Chair, testified today at a hearing titled, "Health of the Commercial Real Estate Markets and

FHFA House Price Index Up 1.2 Percent in February; Up 7.0 Percent from Last...

U.S. house prices rose in February, up 1.2 percent from January, according to the Federal Housing Finance Agency (FHFA) seasonally adjusted monthly House Price Index (HPI®). House

MEDIA ADVISORY: ELEVATOR SAFETY AND STANDARDS ADVISORY BOARD MEETING

The public has the right to attend the meeting at any of the locations. Alternatively, the public may attend the live meeting remotely: The Board assists the NYS Department of Labor and the Commissioner of Labor with regulations, compliance and licensing covering elevators, motorized lifts and walkways, chair lifts and other similar equipment.

Why Roofing Materials Matter When Fixing Up Your Home For Resale

When preparing your home for resale, attention to detail is key to maximizing its value and appeal to potential buyers. While many aspects of home improvement are important, the choice of

U.S. States

President Donald J. Trump Approves Emergency Disaster Declaration for Texas

FEMA announced federal disaster assistance has been made available to the state of Texas to supplement state and local recovery efforts in the areas affected by Hurricane Hanna from July 25, 2020, and continuing

FEMA Fire Management Assistance Granted for the Numbers Fire

The Federal Emergency Management Agency (FEMA) has authorized the use of federal funds to assist the State of Nevada in combating the Numbers Fire burning in Douglas County.

How Much Does It Cost To Start An LLC In Texas?

In the process of setting up your Texas LLC, you'll be faced with quite a few expenses. Some of these are required by legislation, and others are just recommended. We'll cover the costs of setting up an LLC in Texas and also provide you with the informatio

5 Benefits Of Using A Registered Agent In Texas

The services of a registration agent began as part of due process in the US Constitution. A lawsuit includes the legal right to be notified of claims or other legal matters. Here are some brief things that will help explain what a Registered Agent Service In Texas

Avoid TV Tip-Over Incidents During Super Bowl LIV with Safety Tips

The New York State Division of Consumer Protection (DCP) is alerting consumers about the dangers of television (TV) tip-over hazards. Millions of New Yorkers will watch the Super Bowl this Sunday either on TVs at home or at parties with friends. DCP is taking this TV-focused occasion to remind consumers of critical TV safety tips.

Brand-New Single-Tenant Starbucks Drive-Thru Trades in Fresno, Calif. for $1,345 PSF

Hanley Investment Group Real Estate Advisors, a nationally recognized real estate brokerage and advisory firm specializing in retail property sales, announced today that the firm has completed the sale of a brand-new, single-tenant Starbucks

Rosenberg family home for the holidays – and prepared for future hurricanes

A Houston-area mom is sharing her Hurricane Harvey recovery story this holiday season, along with the importance of always being prepared for flood events.

5 Cities in Florida: Which One Makes for the Best Real Estate Investment Opportunity...

Fast-growing Florida has been a favorite of real estate investors for many years. With so much interest having been focused on the state, though, investors need to take care to seek the best available opportunities.

WALTER J. MAHONEY STATE OFFICE BUILDING TO BE SOLD

Office of General Services Commissioner RoAnn Destito today announced that the Senator Walter J. Mahoney State Office Building located at 65 Court Street in Buffalo will be sold at auction in 2020. A work group formed earlier this year made up of City, County, and State officials working with professional real estate consultants CBRE, determined that in the current competitive and robust Buffalo real estate market

Charleston South Carolina expected to outpace national real estate market averages through 2025

The National Association of Realtors® (NAR) recently identified 10 markets expected to outperform over the next three to five years. In alphabetical order, the markets are

WHAT IS THE EVICTION PROCESS IN CALIFORNIA?

Eviction is a dirty word for both tenants and the landlords that believe the time has come to remove one or more parties from an apartment. The process anywhere can lead to a strained relationship at best and a bitter acrimonious fight that ends up in the judicial system.

FEMA Offers Free Rebuilding Tips at Local Home Improvement Stores

Disaster survivors affected by the severe storms and floods from Tropical Storm Imelda, can visit local home improvement stores in Katy, Houston and Spring from Monday, Dec. 9, to Saturday

Florida Tops ABC’s Annual Merit Shop Scorecard State Ranking for Second Year in a...

Associated Builders and Contractors released its 2019 Merit Shop Scorecard today, an annual ranking based on state policies and programs that encourage workforce development, career and technical education

Top 4 Places to Buy a Second Home in the US

There are about 7.4 million homes owned as a second home in the United States. For many people, their second home is a vacation home. This gives them a chance to get away and break routine while also having all of the comforts of being in their own home.

Ribbon Cutting Celebrating New Affordable Apartments in the Bronx for Low-Income Families and Domestic...

New Destiny was joined by supporters and colleagues to celebrate the opening of its newly constructed service-enriched affordable housing project - The Jennings - located in the Crotona Park East

HUD AWARDS $1.5 MILLION TO PUBLIC HOUSING AUTHORITIES TO ASSIST YOUNG PEOPLE AGING OUT...

U.S. Housing and Urban Development (HUD) Secretary Ben Carson today awarded $1.5 million to nearly a dozen housing authorities to assist young people aging out

BLM NAMES VETERAN LAND MANAGER TO LEAD CALIFORNIA STATE OFFICE

The Bureau of Land Management today announced that Karen Mouritsen has been named the new California State Director—a key leadership position based in Sacramento. As State Director, Mouritsen will direct a team that manages lands encompassing 15% of the Golden State’s total land mass

California Real Estate Developer Convicted of Making Conduit Contributions in Two U.S. Congressional Campaigns

Today, a federal jury found an Oakland-area real estate developer guilty for funneling tens of thousands of dollars through straw donors into two consecutive congressional campaigns

NYS OASAS ANNOUNCES OPENING OF NEW RECOVERY CENTER IN NEW YORK CITY

The New York State Office of Alcoholism and Substance Abuse Services (OASAS) today announced the opening of the new JLC Recovery and Wellness Center in New York City. JLC is operated by Exponents Inc. and provides free help and support services for people affected by addiction and for their families.

Robust U.S economy not a boost for black homeownership

In spite of a robust U.S. economy, a strong employment rate, and steadily increasing 401(k) plan earnings, Black homeownership rates continue to drop. Drawing from the 2019 release of the National Association of Real Estate Brokers

Popular

SIXTY PERCENT OF FIRMS WORKING ON HIGHWAY UPGRADES EXPERIENCED CARS CRASHING INTO THEIR WORK...

Annual Survey by HCSS and Associated General Contractors of America Finds Drivers and Passengers are at Greater Risk of Injury and Death in Work Zone Crashes As Officials Urge Drivers

New Home Sales Decline in May

Sales of newly built, single-family homes fell 7.8 percent to a seasonally adjusted annual rate of 626,000 units in May, according to newly released data by the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

$17+ Million in Grants Will Help States, Local Communities Keep Waters Clean, Economies Thriving

Water-loving outdoor recreationists and local communities in 27 states will have additional resources to help boaters keep America’s waters clean, thanks to more than $17 million in Clean Vessel Act program grants from the U.S. Fish and Wildlife Service.

Port Aransas ready for return of summer tourism

Texas SandFest drew a record 35,000 people April 26-28, encouraging business owners that Port Aransas is on its way to recovery. With nearly all the city’s retailers and restaurants re-opened, residents are beginning to feel like things are getting back to normal.

OJO Labs: Five Months, Eight Major Awards

OJO Labs, a leading-edge technology company on a mission to empower consumer decision-making through its conversational AI assistant, OJO, won the highly coveted 2019 A-List Award among mid-sized companies from the Austin Chamber of Commerce in partnership with SXSW

Should I Rent Out my Property on Airbnb?

Listing property on Airbnb has become a popular way to make extra money, meet new people, and provide some freedom, but there are a few key things to think about when you are considering listing your property. It is key to know what you’re getting yourself into.

The Rockefeller Foundation Launches $5.5 Million Opportunity Zone Community Capacity Building Initiative for Select...

The Rockefeller Foundation today announced an initiative to help U.S. cities attract responsible private investment in economically-distressed communities through Opportunity Zones created in the 2017 Tax Cuts and Jobs Act. This effort will help ensure new investment delivers sustainable benefits for more than 30 million low-income Americans living in Opportunity Zones

Eden Housing and City of Fremont Celebrate Grand Opening of KTGY-Designed Affordable Senior Housing...

Pauline Weaver Senior Apartments is located in the Warms Springs area of Alameda County and features 90 apartment homes for very low and extremely low-income seniors, near I-880 freeway, BART, shopping, services and other amenities.

VA’s Home Loan Guaranty program notifies Veterans of potential loan fee waivers

The U.S. Department of Veterans Affairs (VA) announced May 13 that Veterans who qualify for a VA Home Loan funding fee waiver are now being notified in their home loan eligibility certificate and disability compensation award letter.

A Stellar Idea: My Florida Regional MLS Reimagines the Multiple Listing Service

The nation's third-largest Multiple Listing Service, My Florida Regional MLS, will become Stellar MLS on June 4, 2019, in a move that totally reimagines the MLS. Currently serving 58,000 customers

NATIONAL ASSOCIATION OF HOME BUILDERS TO CO-HOST HUD INNOVATIVE HOUSING SHOWCASE

U.S. Department of Housing and Urban Development (HUD) Secretary Ben Carson today announced the National Association of Home Builders (NAHB) will co-host the Department's inaugural "Innovative Housing Showcase." The Innovative Housing Showcase will be held on the National Mall June 1-5, 2019

Department of the Interior: Yakima Water Plan Is a “Model” and “Holistic”

Yesterday, U.S. Senator Maria Cantwell (D-Wash.), ranking member of the Senate Energy and Natural Resources Committee, asked the Department of the Interior about its commitment to the Yakima River Basin during a hearing on the president’s FY 2017 budget request. Deputy Secretary of the Interior Michael Connor agreed with Sen. Cantwell that the Yakima River Basin plan “is a model for the rest of the nation in water management.”

Energy Costs to Cook Thanksgiving Meal Up to 25% Lower in 2015

“Consumers Energy is thankful to be a part of holiday celebrations across the state as warm Thanksgiving memories are being made, and we are committed to providing many more generations of Michigan families with reliable, affordable energy in all seasons,” said Garrick Rochow, Consumers Energy’s vice president and chief customer officer

Agencies Issue Final Rule to Exempt Subset of Higher-Priced Mortgage Loans from Appraisal Requirements

WASHINGTON, D.C. - December 13, 2013 - (RealEstateRama) -- Six federal financial regulatory agencies today issued a final rule that creates exemptions from certain appraisal requirements for a subset of higher-priced mortgage loans. The exemptions are intended to save borrowers time and money while still ensuring that the loans are financially sound

Department Enters into Consent Order with Equity Loans, LLC and its owners Eduardo Gutierrez...

Atlanta, Georgia - November 13, 2013 - (RealEstateRama) -- the Georgia Department of Banking and Finance (“Department”) entered into a Consent Order with Equity Loans, LLC, License Number 23300, located at 1150 Hammond Dr., Building E, Suite 650, Atlanta, Georgia 30328, to resolve allegations pertaining to violations of the Georgia Residential Mortgage Act